Fitch Ratings, one of the "Big Three" credit rating agencies, plays a crucial role in the global financial landscape. Its ratings are widely recognized and trusted by investors, governments, and institutions to assess the creditworthiness of various entities. The Fitch Rating List is a comprehensive compilation of ratings assigned to sovereign nations, corporations, and financial instruments. Understanding this list can provide valuable insights into the stability and risk associated with different financial entities.

As an investor or financial professional, navigating the complexities of credit ratings can be daunting. The Fitch Rating List serves as an essential tool in evaluating the financial health and credit risk of borrowers. By analyzing the ratings provided by Fitch, stakeholders can make informed decisions about their investments and strategies. This guide will help you delve deeper into the world of Fitch Ratings, exploring its methodologies, significance, and impact on the global economy.

With the volatility of global markets, staying updated with the latest credit ratings is more important than ever. The Fitch Rating List offers a snapshot of the financial landscape, reflecting the economic and political factors influencing creditworthiness. Whether you are a seasoned investor or a newcomer to the financial world, understanding the Fitch Rating List can enhance your financial acumen and confidence in making sound investment choices. Let's explore the intricacies of this vital financial resource.

Read also:If You Can Make Her Laugh And Giggle Meme The Power Of Humor In Relationships

Table of Contents

- What is Fitch Rating?

- How does Fitch determine its ratings?

- Why is the Fitch Rating List important?

- Fitch Rating Scales and Categories

- How to interpret the Fitch Rating List?

- What factors influence Fitch ratings?

- The impact of Fitch ratings on global markets

- Fitch Rating List vs. other rating agencies

- How often is the Fitch Rating List updated?

- Case studies of Fitch ratings

- Criticisms and controversies surrounding Fitch ratings

- How to use the Fitch Rating List for investment decisions?

- Future trends in Fitch ratings

- Conclusion

- Frequently Asked Questions

What is Fitch Rating?

Fitch Ratings is a globally recognized credit rating agency that provides credit ratings, research, and analysis for various financial entities. It assesses the creditworthiness of sovereign nations, corporations, and financial instruments, offering insights into their financial health and risk levels. The ratings are used by investors, financial institutions, and governments to make informed decisions about lending, investing, and policy-making.

How does Fitch determine its ratings?

Fitch Ratings employs a rigorous methodology to assess the creditworthiness of entities. This process involves analyzing a range of quantitative and qualitative factors, including financial performance, economic conditions, management quality, and market trends. The agency's analysts use these criteria to assign ratings that reflect the likelihood of default and the entity's ability to meet its financial obligations.

Why is the Fitch Rating List important?

The Fitch Rating List is a valuable resource for investors and financial professionals, providing a comprehensive overview of credit ratings across different sectors and regions. It helps stakeholders assess credit risk, make informed investment decisions, and develop effective financial strategies. Additionally, the list serves as a benchmark for comparing the creditworthiness of various entities, enhancing transparency and trust in the global financial system.

Fitch Rating Scales and Categories

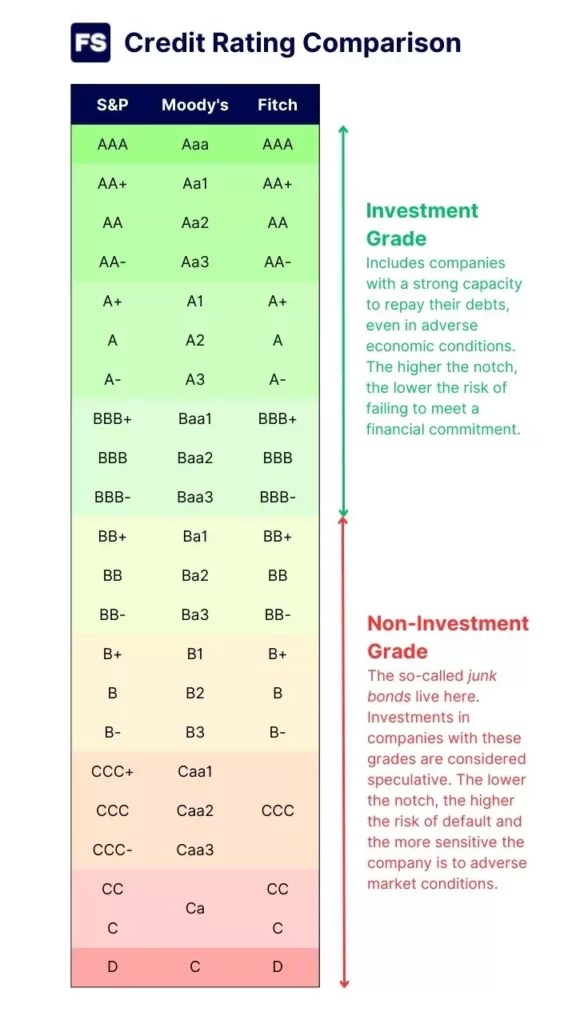

Fitch Ratings uses a standardized scale to categorize credit ratings, ranging from 'AAA' (highest credit quality) to 'D' (default). The scale is divided into investment-grade and speculative-grade categories, with each rating reflecting a different level of credit risk. Understanding the Fitch rating scale is essential for interpreting the Fitch Rating List and evaluating the creditworthiness of different entities.

How to interpret the Fitch Rating List?

Interpreting the Fitch Rating List requires an understanding of the rating scales and the factors that influence credit ratings. Investors should consider the context of each rating, such as the economic and political environment, industry trends, and the specific circumstances of the rated entity. By analyzing these factors, stakeholders can gain insights into the potential risks and opportunities associated with different investments.

What factors influence Fitch ratings?

Several factors influence Fitch ratings, including:

Read also:Celebrating The Golden Era Of Laughter Old Comedians From The 80s

- Financial performance: Revenue, profitability, and cash flow are key indicators of an entity's ability to meet its financial obligations.

- Economic conditions: Macroeconomic trends, such as GDP growth and inflation, can impact an entity's creditworthiness.

- Management quality: Effective leadership and governance practices are crucial for maintaining financial stability.

- Market trends: Industry dynamics, competition, and regulatory changes can affect an entity's credit risk.

The impact of Fitch ratings on global markets

Fitch ratings have a significant impact on global markets, influencing investor behavior, lending decisions, and borrowing costs. High ratings can enhance an entity's reputation, attracting investment and reducing interest rates. Conversely, downgrades can lead to increased borrowing costs, reduced market confidence, and potential financial instability. Understanding the implications of Fitch ratings is essential for navigating the complexities of the global financial system.

Fitch Rating List vs. other rating agencies

While Fitch Ratings is one of the leading credit rating agencies, it is important to consider the perspectives of other agencies, such as Moody's and Standard & Poor's. Each agency has its own methodologies and criteria for assessing creditworthiness, resulting in potentially different ratings for the same entity. Comparing ratings from multiple agencies can provide a more comprehensive view of an entity's credit risk and financial health.

How often is the Fitch Rating List updated?

The Fitch Rating List is regularly updated to reflect changes in the creditworthiness of entities and the global economic environment. Updates may occur in response to new financial data, economic developments, or significant events that impact an entity's credit risk. Investors should monitor these updates to stay informed about the latest credit ratings and adjust their investment strategies accordingly.

Case studies of Fitch ratings

Examining case studies of Fitch ratings can provide valuable insights into the agency's methodologies and the factors influencing credit ratings. These case studies can highlight the impact of economic shocks, management decisions, and market trends on creditworthiness, offering lessons for investors and financial professionals. By analyzing real-world examples, stakeholders can better understand the complexities of credit ratings and their implications for investment decisions.

Criticisms and controversies surrounding Fitch ratings

Despite its reputation as a leading credit rating agency, Fitch Ratings has faced criticisms and controversies over its methodologies and the accuracy of its ratings. Some critics argue that the agency's ratings may be influenced by conflicts of interest or fail to accurately reflect the credit risk of certain entities. Understanding these criticisms is important for evaluating the credibility and reliability of the Fitch Rating List.

How to use the Fitch Rating List for investment decisions?

Investors can use the Fitch Rating List to assess the credit risk of potential investments and develop informed investment strategies. By analyzing the ratings and considering the factors influencing creditworthiness, stakeholders can identify opportunities and mitigate risks. Additionally, the list can serve as a benchmark for evaluating the performance of investment portfolios and making adjustments to achieve financial goals.

Future trends in Fitch ratings

As the global economy continues to evolve, Fitch Ratings is likely to adapt its methodologies and criteria to address emerging trends and challenges. Factors such as technological advancements, climate change, and geopolitical developments may influence the agency's approach to assessing creditworthiness. Staying informed about these trends can help investors anticipate changes in the Fitch Rating List and adjust their strategies accordingly.

Conclusion

The Fitch Rating List is an indispensable tool for investors and financial professionals, offering insights into the creditworthiness of various entities. By understanding the methodologies, scales, and factors influencing Fitch ratings, stakeholders can make informed decisions and navigate the complexities of the global financial landscape. As the financial world continues to evolve, staying updated with the latest credit ratings and trends is crucial for achieving investment success.

Frequently Asked Questions

What is the difference between Fitch Ratings and other credit rating agencies?

Fitch Ratings, Moody's, and Standard & Poor's are the "Big Three" credit rating agencies, each with its own methodologies and criteria for assessing creditworthiness. While their ratings may differ, they all provide valuable insights into the credit risk of various entities.

How can I access the Fitch Rating List?

The Fitch Rating List is available on the Fitch Ratings website and through financial data providers. Investors can access the list to stay informed about the latest credit ratings and make informed investment decisions.

Are Fitch ratings always accurate?

While Fitch Ratings is a reputable agency, no credit rating is infallible. Investors should consider multiple sources and factors when assessing credit risk and making investment decisions.